Reports

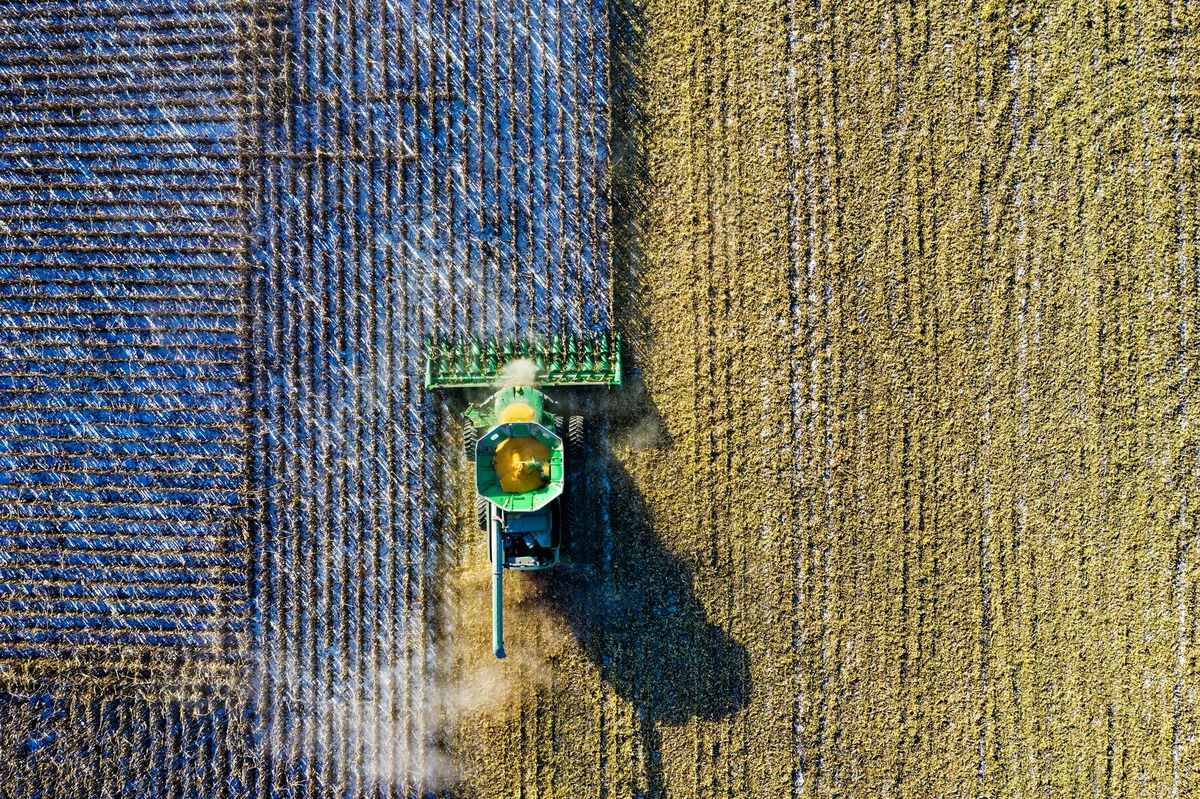

Agricultural Industry in Kazakhstan. Part 2

July 20, 2020

Introduction

In the first part of a series of articles on agriculture, we have tried to formulate a conceptual vision of the main directions of development of the agricultural sector in the economy of Kazakhstan. Three main development areas were grouped together on the basis of analyzed sources: driver of the economy, food security and social development in rural areas.

The first direction that is actively discussed in state policy is the "driver of the economy". In order to answer the question "Is agriculture the driver of the economy of Kazakhstan?", it is necessary to have a clear understanding of what characteristics we put into this formulation.

There are many different opinions about individual factors of the "driver of the economy" and subsequent complex intersectoral linkages. For the purpose of this analysis, we decided to focus on a fairly specific, but at the same time very capacious definition:

"The driver of the economy is the engine of economic activity that stimulates the local economy, contributing to the growth of jobs, trade and investment."

The purpose of this article is to provide an objective picture of the economic condition and competitiveness of agriculture. The article contains 5 sections:

1. Employment

2. Trade

3. Investment

4. Economic return

5. Characteristics of the "driver of the economy"

Employment

According to the classification of the International Labour Organization, employment is characterized by quantitative and qualitative indicators. Quantitative indicators include the sectoral structure and specifics of employment, including the number of jobs and the share of employment in the sector. Qualitative indicators include the level of wages and education, labor productivity, and the multiplicative effect of employment.

Employment indicators, as a component of the "driver of the economy", are characterized by high labor productivity with a relatively low share of employment, high-quality jobs, highly qualified personnel, and the creation of high demand for jobs in related industries.

Quantitative indicators

The evolution of employment in agriculture has a negative trend, characterizing the transformational processes of transition to industrial development in the world economy.

The largest outflow of labor in the economy of Kazakhstan is observed in agriculture – almost 2 times over the past 10 years (more than 1.1 million people). The average annual rate of decline in employment in the agricultural sector in 2009-2019 was 6.4%, which is a record in comparison with other industries. At the moment, employment in agriculture is 1.2 million people. A special feature of the sector is the high percentage of self-employed people - 64.6%.

Figure 1. Change in employment, ths. people

However, changes in the methodology distort the real picture of employment in the agricultural sector. Self-employed individuals in agriculture include private farm households (PFH) that produce (1) partial products for consumption and sale, or (2) only for sale. The share of the labor force in the agricultural sector is 13.5% using the new methodology according to the resolution of the 19th International Labour Conference since 2014. This methodology takes into account only the second subgroup of PFH in the classification of self-employed individuals. If both subgroups are included, employment in agriculture increases to 1.6 million people. or 17.7%.

Figure 2. Employment in agriculture, mln people

When comparing the share of employment in the global economy, it can be seen that in developed countries employment in agriculture does not exceed 10% (Figure 3) : in New Zealand - 6.6%, Australia - 2.6%, Canada - 2.0% and the USA - 1.7%. In Russia, the share of employment is 6.7%, Belarus - 9.9%, Ukraine - 14.9%, China - 17.5%, Brazil - 10.3%, Uzbekistan - 21.9%, Kyrgyzstan - 26.7% and Mongolia - 30.4%.

Figure 3. Employment in agriculture 2017, %

Qualitative indicators

In terms of wages, agriculture remains the least attractive industry. With the country-level average monthly salary of 160 thousand tenge, the salary in agriculture is minimal – only 90 thousand tenge. In 2012-2018, wages increased almost 2 times, amounting to 98 thousand tenge. At the same time, the agricultural sector is the leader in the average annual growth rate of wages – 11.4%. However, even such growth rates are insufficient, since the gap with the second minimum indicator is 14.5%.

Figure 4. Average monthly salary in 2018, ths. tenge

The level of wages depends on labor productivity, which in 2018 amounted to 2,077 thousand tenge. Since 2010, this indicator has increased 2.4 times. The average annual growth rate and productivity growth in agriculture over the past 8 years are the highest among all sectors – 11.6% and 141.1%, respectively. Despite this, labor productivity in agriculture is lower than in most sectors of the region. In 2018, according to this indicator, the industry rose from the last position in 2010 by only 3 positions up.

Figure 5. Labor productivity in 2018, ths. tenge.

When comparing the labor productivity of our country with other countries, the low indicator of Kazakhstan becomes more pronounced (figure 6) . Kazakhstan has a similar labor productivity ($5.6 ths. dollars) to China (5.8 ths.). However, the gap with Russia (13.7 thousand) and Belarus (12.2) is 2.4 and 2.2 times, respectively. Labor productivity in Brazil is 12.4 thousand. More significant figures represent 99.6 thousand in New Zealand, 92.7 thousand in Australia, 83.7 thousand in the USA and 72.1 thousand in Canada. The gap with these countries ranges from 12.9 to 17.8 times.

Figure 6. Labor productivity in agriculture 2017, ths. Dollars in 2010 prices

If we consider the level of education of agricultural workers in the country, the agricultural sector is characterized by the least qualified labor force. It is the agriculture sector that has the highest share of employment with primary, basic and secondary general education – almost half of all employed in agriculture (47%). The share of employees with higher education is only 13%. However, the low level of employees with higher education is not typical only for Kazakhstan. For example, in Australia, this figure is also 13%. However, this does not contribute to the fact that labor productivity in Australia is $93 thousand dollars, and in Kazakhstan it is $6, 000.

Figure 7. Employed population by level of education, %

Admission of students to higher education institutions in the specialty "Agricultural Sciences" amounts to 2 139 people or only 1.9%. 1.1% of students were admitted to the specialty "Veterinary Medicine". After 2014, the number of students in agricultural sciences has been decreasing at an average annual rate of 5.6%. The share of students decreased by 1.2 percentage points.

Figure 8. Admission of students to higher education institutions in the specialty "Agricultural Sciences".

In the 2019-2020 academic year, 1,600 grants were allocated for "Agricultural Sciences" (3.0%) and 835 for veterinary science (1.5%) – that is, about 75% of students in the specialty of agricultural sciences study on the basis of scholarship. Since January 2020. The Ministry of Agriculture has been delegated the right to form the volume, approve the distribution and placement of state orders for training specialists in agricultural specialties.

At the same time, the requirements for vacancies in agriculture on the electronic labor exchange reflect the demand for unqualified workforce. For example, for more than half of the vacancies it is enough to have general secondary education – 51.4%, while higher education is only required for 4.1% of posted vacancies.

One of the most effective qualitative indicators of jobs in the industry is the employment multiplier. Unfortunately, employment in the agricultural sector (1 work position) creates one of the lowest demands in related industries – 0.3 work positions.

Figure 9. Employment multiplier by sector

If we look at the aggregate effect of all employed in the industry, it can be seen that despite the high employment of 1.2 million people, this creates only 311 thousand additional jobs in different industries. In the manufacturing industry, where employment is more than 2 times lower, the cumulative effect is 2.3 times higher. Comparatively high indicators are also observed in mining, construction, and trade.

Figure 10. Cumulative effect of employment, number of additional jobs created in different industries

Conclusions:

In terms of employment and job creation, agriculture is not an economic driver for several reasons:

High unproductive employment

With the highest share of employed people (17.7% including PFH), the agricultural sector is characterized by the lowest labor productivity among all sectors. Moreover, a high share of self-employed workers prevails (64.6%) in the form of households, which in most cases only partially produce products for sale;

Lack of quality jobs

Agriculture is characterized by 1) the lowest wage despite stable growth rates; 2) instability of the labor market due to exposure to seasonal fluctuations: 3) low level of demand for highly qualified labor force and, as a result, the highest share of workers with basic secondary education;

Creating minimal secondary demand for jobs

Low coefficient of the multiplier of employment in related industries.

Trade

Components of the "economic driver" of this section should be characterized by high growth rates of the industry through indicators of gross domestic product, gross value added, positive technological complexity of the export basket of agriculture and high coefficients of multipliers of GVA and output.

GVA

The GVA of agriculture is 3,065 billion tenge. Since 2010, the gross value added has increased by 1.4 times. The agricultural sector ranks 7th, behind industry, trade, transport and warehousing, real estate operations and construction. In recent years, the share of agricultural sector has stabilized at 4.4% of the country's GDP.

Figure 11. GVA of agriculture in real prices 2019, billion tenge.

Average annual GVA growth rates for 2010-2019 were 3.7%, which is a comparatively average figure. At the same time, agriculture is ahead of the manufacturing and mining industries.

Figure 12. Average annual GDP growth rate 2010-2019

In comparison with the countries of the macroregion, the GVA growth rate of agriculture in Kazakhstan is significantly lower than in Mongolia (9.2%), Uzbekistan (4.6%), Ukraine (4.2%) and China (3.8%). At the same time, the country's agricultural sector is outpacing the growth rates of many other countries with similar economic, territorial and climatic factors, which are among the leading countries in terms of the efficiency of agricultural development. The world growth rate is 2.8%.

Figure 13. World agricultural growth rates in 2010-2019, %

Export basket and index of product complexity

The global agricultural market went through some structural changes between 2000 and 2016, largely due to sustainable demand growth in developing countries (Russia, Brazil, India, China and Indonesia). As a result of higher per capita income, imports of agricultural products increased, while export growth resulted from higher productivity in the agricultural sector. The average annual growth rates in the volume of world trade in agricultural products was 6.7%: from $570 billion in 2000 to $1.6 trillion dollars in 2016.

The top 5 importers of agricultural products represent 64.3% of world imports: European Union countries - 39.1%, USA - 10.1%, China - 8.2%, Japan - 4.2% and Canada - 2.7%. The list of the leading exporting countries is presented by the same countries, except for Japan: European Union - 41.1%, USA - 11%, Brazil - 5.7%, China - 4.2 and Canada - 3.4%. They represent 65.4% of agricultural exports.

In the foreign trade of Kazakhstan, exports of agricultural goods amount to $2.7 billion dollars or 5.2%, imports - $ 1.8 billion or 7.7%. As part of the implementation of the State Program For Development of the agro-industrial complex for 2017-2021, one of the goals is to develop the export of processed agricultural products. At the moment, the export basket is largely based on raw materials: 66% of raw materials against 34% of processed products . In just one year, the share of processed products decreased by 3 percentage points.

Figure 14. Export of agricultural products, %

In world exports of processed agricultural products ($863 billion dollars). Kazakhstan ranks 68th with a volume of 1.1 billion dollars. (0.12%). Estonia, Bolivia, Nicaragua and Myanmar export a similar share. The top 10 exporters represent more than half of the production (51.0%).

Figure 15. Top 10 world exporters of processed agricultural products in 2019, billion dollars

Based on the list of product names of processed products, it is possible to analyze positions by the product complexity index. The index is calculated based on the diversity of countries that produce a particular product and the prevalence of other products produced by these countries . A positive index coefficient indicates the technological complexity of a product that can be produced in a particular country. Out of 113 positions of Kazakhstan's exported processed agricultural products, only 21 have a positive product complexity index. Derivative products such as peptones, dextrins, gluten, casein, albumins, etc. have a high complexity index. More familiar products such as cheese and quark, bread and baked products, vegetables, olive oil, cereals, flour etc. have a low difficulty index, i.e. production does not require much technological effort and more countries produce these agricultural products. In the future, it is necessary to expand not only the volume of exports of processed products, but also the variety of commodity items based on technological improvements in the production base.

Figure 16. Product Complexity Index

Multiplicative effect

The multiplier coefficient is characterized by relatively average coefficients of both output and gross value added: 1 tg of additional output of agriculture creates demand in the economy by 0.58 tg, while 1 tg of additional GVA – 0.62 tg. In both indicators, the fishery coefficient is the lowest among all sectors.

Figure 17. I-type multiplier by (1) output and (2) GVA

Conclusions:

In terms of trade, agriculture is not a driver of the economy for a number of reasons:

Average growth rate of the domestic economy sector

Despite the fact that the industry is growing faster than in the countries of the macroregion and other developed countries, the growth rate of GVA of agriculture is on the 9th place among all sectors of Kazakhstan

Low technological complexity of agricultural products

The prevailing part of exported agricultural products is characterized by a low index of product complexity

Average multiplicative effect of output and GVA of the industry

An additional 1 tg of agricultural output creates demand for only 0.58 tg, significantly behind a large number of industries

However, there is a prospect of expanding the trade potential of the industry, as the growth rate of the GVA of agricultural sector in Kazakhstan exceeds the world average by 32%.

Investments

In order to be considered a "driver of the economy", agriculture needs to be attractive to both domestic and foreign investment sources.

Investments in fixed assets of agriculture amounted to 365 billion tenge in 2018. In terms of investment volumes, the contribution to agriculture is behind industry, transport and warehousing, and real estate operations. Over 16 years, investment in agriculture has increased by 7.4 times. At the same time, the share of investments does not have a stable trend. The average annual growth rate amounts to 15.5%.

Figure 18. Investments in areas of use, 2018 (billion tenge) and investments in agriculture in real prices, 2018.

Agriculture is characterized by a high rate of investment growth when compared with other industries. If the agricultural sector was on the 4th place in terms of total investment volume, the industry is on the 3rd place in terms of growth rate, behind only accommodation and nutrition services and other types.

Figure 19. Average annual growth rate of fixed assets investment in real prices 2018

Among the sources of financing, proprietary funds represent 75.7% of investments. Bank loans make up 12.4%, other borrowed funds-11.9%.

When looking at the target distribution of services in more detail, it can be seen that the volume of investments in crop production exceeds the funds invested in livestock production by 1.7 times. Investments in crop production amount to 216 billion tg or 59.2%, livestock - 125 billion tg or 34.2%, fisheries and fish farming - only 465 million tg or 0.1%.

Figure 20. Distribution of investments in agriculture in 2018, million tenge.

Gross Fixed Capital Formation (GFCF) represents the investment of resident units in fixed capital objects to create new income in the future by using them in production. This indicator of agriculture in Kazakhstan was 2.5% of total GFCF in 2016 . The overall trend of the GFCF share of agricultural production in the countries is stable (2010-2016). The maximum fluctuations (both in Kazakhstan and in the 11 participating countries) are at the level of + / - 0.8 p.p.

Figure 21. Gross Fixed Capital Formation in agriculture 2016, %

If we look at the volume of attraction of foreign investments (FDI), agriculture is the least attractive sector in the country. By the end of 2019, about $ 10 million dollars were raised. In addition to significant gaps with the mining and manufacturing industries, investment in trade exceeds the contribution to the agricultural sector by almost 300 times.

Figure 22. Foreign investment inflow 2019, million dollars

In addition to the low level of FDI in agriculture, there is a significant negative trend in investment volumes. After a maximum figure of $ 71.8 mln. dollars, over the past 4 years, investment has decreased by more than 7 times.

Figure 23. The inflow of foreign investment in agriculture, mln. dollars

The low level of FDI in the agricultural sector of Kazakhstan becomes more pronounced when compared with other countries. According to the data from FAO in the period from 2010-2017, the volume of foreign investment varied in the region of 12-403 ths. dollars in Australia, 297-1422 thousand dollars in the US, 388-685 thousand in Argentina, 704-1700 thousand in China and 834 thousand in Brazil. Similar to Kazakhstan, the global level of support for agriculture through FDI varies significantly from year to year.

Conclusions:

In terms of investment, agriculture is also not a driver of the economy for a number of reasons:

The average volume of investment in fixed assets

Despite significant average annual growth rates, the gap with the top 3 industries remains quite significant;

Low level of foreign direct investment inflow

With a consistent decline in investments from 2015, agriculture is the least attractive sector for attracting foreign investments.

Economic return

To analyze the effectiveness of the economic return of the sector, it is proposed to consider the level of state financing of the industry and the amount of tax revenue from agricultural producers.

Public support

According to the OECD methodology for estimating public support to agriculture is a support to farmers (PSE) in a percentage ratio of gross producer income. This financial measure is intended to reduce the intersectoral gap between producers who are engaged in agriculture and those who are involved in other industries.

In Kazakhstan, the level of support was 5.7% of gross income of producers, which is a relatively average indicator. For example, in Russia the support amounts to 13.2%, in Canada – 8.8%. At the same time, reduced public support to farmers is given in Brazil – 1.5%, New Zealand - 0.5%. Despite the average indicator, the level of support for Kazakhstan's agricultural producers, as estimated by the OECD methodology, is extremely unstable. The largest share of public support from the gross income of producers in Kazakhstan was over 1/4 in 1998, while in recent years the level of support has significantly decreased. Fluctuations are related to changes in market economy support (through negative price transfers of crop exports and price support for livestock imports) and the subsequent impact of budget transfers.

Figure 24. Support for farmers in Kazakhstan (PSE), % of gross income of producers

According to the Ministry of Finance, state budget expenditures on agriculture (including specially protected natural areas, protection of the environment and wildlife, land relations) amounted to 583 billion tenge or 4.3%. Over the past 9 years, the share of expenditures on the agricultural sector has not exceeded 5%. The maximum expenses were provided for in 2011 (5.0%), and the minimum – 3.8% in 2013 and 2017. According to data from FAO, developed countries in Europe with high incomes determine the smallest share of budget expenditures on agriculture – less than 1%.

Figure 25. Distribution of the state budget expenditures 2019, bln. tg.

The Agricultural Orientation Index (AOI) has been adopted as one of the indicators of sustainable development goals. The index is calculated based on the ratio of two indicators of the agricultural sector: share of expenditures from the state budget (4.4%) and share of contribution to GDP (4.3%). The index coefficient for Kazakhstan is 0.9, which indicates a relatively higher orientation/priority on agriculture. In the case of our country, the economic return almost completely reflects the expenditures in a ratio of 1: 1.

According to World Trade Organization (WTO) classification, public support measures are divided into three groups – green, yellow (amber) and blue (blue basket). The green basket includes measures that do not have a direct impact on production growth and trade restrictions, such as compensation for losses from natural disasters, veterinary development, insurance, human resources training, research and development, and others. The yellow basket includes measures that stimulate agricultural production and have a direct impact on agricultural trade, including intervention purchases, subsidies and compensations, and various benefits. The blue basket contains measures aimed at restricting production in a certain manner. For the purpose of sustainable development of the agricultural sector, the green basket measures are considered to be the most effective.

The data on expenditures of the Ministry of Agriculture in the context of state programs for 2019 show informations on the budget distribution of 421 billion tenge. Expenditures on the state program of agro-industrial complex development make 295 billion tg. (70%), the program for development of productive employment and mass entrepreneurship - 78 billion tg. (19%) and 48 billion tg (11%) for other expenditures not included in the program documents. Taking into account the classification of public support measures of the WTO, the distribution of the state budget of agriculture of Kazakhstan mainly consists of less effective measures of the "yellow basket". Thus, subsidies account for 56% of all expenditures of the Ministry of Agriculture, or 165 billion tenge. More long-term green basket measures amount to only 32 billion tg or 8%. The intensification of the agricultural sector, as a key focus of the agro-industrial complex program, should be aimed at expanding public support measures of the "green basket".

Figure 26. Distribution of expenditures of the Ministry of Agriculture for 2019

Tax revenue

The system of taxation of agriculture is aimed at the maximum reduction of the tax burden of agricultural producers: a special tax regime for three types of agricultural producers and three types of benefits under the generally established tax regime. Benefits include VAT reduction, special settlement procedure, payment of tax liabilities in the amount of 30%, reduction of social tax rate, etc.

Figure 27. The system of taxation of agriculture

Due to the low tax burden and despite the significant financial support for the agricultural sector, the return represents only 11% of the expenses. With the government budget of 421 billion tg for state programs under the framework of developing agriculture, tax revenues from agricultural producers amount to only 45.7 billion tg . Small enterprises (up to 50 people) are responsible for 45% of taxes, 29% for medium enterprises (up to 250 people) and 26% for large enterprises (over 250 people).

Enterprises specializing in crop production make up 26.7 billion tg or 58.2% of tax revenues. Livestock products make up 8.4 billion tg or 18.4%. Fishery brought in 869 million tenge or 1.9%.

Figure 28. Distribution of tax revenues of agricultural producers by type of activity, %

Conclusions:

In terms of trade, agriculture is not a driver of the economy for a number of reasons:

There is no stable level of public support for producers

Frequent changes in the volume of support for the market economy and budget transfers;

Insufficient distribution of public support measures

A high percentage of the budget is focused on providing subsidies;

Low tax revenue

Low returns compared to the level of government funding.

Characteristics

of the "driver of the economy»

With regard to the key performance indicators of the industry, there is a need for significant growth in labor productivity and wages. As a result, a significant reduction in the number of people employed in the agricultural sector will be required. If we assume that …

wages in agriculture will be equal to the national average (160 thousand tenge instead of 90 thousand tenge.)

and the level of monetary expenditures on labor remuneration from gross value added (26.1%) and the share of GVA of the agricultural sector in total output (56%) …

... in this case, the output of agriculture should be 16.1 trillion tenge. For comparison, the total output of crude oil and products of refined oil is 14.3 trillion tenge. The output of agriculture is now only 5.1 billion tenge.

As mentioned earlier, the Agricultural Orientation Index (AOI) is 0.9 for Kazakhstan. However, in most countries, the index is 0.5, while the world average is 0.26. At the same time, if the agricultural sector of Kazakhstan produced the same high level of economic return, the contribution to GDP should be 8.6% or 16.5%, respectively.

If focusing on one of the benchmarks of the macroregion countries with the existing labor productivity of 5.6 thousand dollars, the goal can be compared with the indicator of Belarus (12.2 thousand), since productivity in other countries is even higher. Thus, considering that...

labor productivity in Kazakhstan would be 2.2 times higher

the volume of gross value added is maintained …

... then employment in the agricultural sector should be 7.3%. Currently, employment makes up 13.5% or 17.7% (including PFH). It is worth asking a simple question: is it really possible to reduce employment in agriculture by 2 times? This accounts for more than 600 thousand people.

In addition, it is necessary to develop the technological production base in order to increase the export of processed products to at least 50% instead of 34%. Intensification of production to increase output will also require significant domestic and foreign investments.

Conclusion:

The definition of the driver of the economy, on the basis of which the analysis was made earlier, is "an engine of economic activity that stimulates the local economy by promoting job growth, trade and investment." As a result of the analysis, it can be concluded that at the moment it is difficult to call agriculture the "driver of the economy" because of the mismatch with the required characteristics: the existing indicators should be 2-3 times higher.

Even if the agricultural sector is not the driver, agriculture remains an integral part of the economy, which is developing at a fairly steady pace.

The next article will discuss the state of agricultural development as a means to ensure food security.

Links:

Data – World Labor Organization, World Bank, WTO, Committee On Statistics Under The Ministry Of National Economy, OECD, FAO, E-labor Exchange Enbek.kz, Atlas of Economic Complexity, Our World in Data

Cover – web site Pexels.com

The article on our website – https://crcons.com/rus/agriculture_in_Kazakhstan_2

The first part of the article – https://crcons.com/rus/agriculture_in_Kazakhstan_1

share

article

all publications